Sizing and Spotting Opportunities

This article offers my take on two popular questions. What's the size of the market in African retail eCommerce? Where are the opportunities?

The question of market size keeps coming up, especially in nascent markets in Africa. The lazy and popular method is to extrapolate the population and mobile penetration numbers. An alternative and equally misleading method is to cite a big-name consulting firm that showed the eCommerce numbers by 2025 or 2030 with X% CAGR.

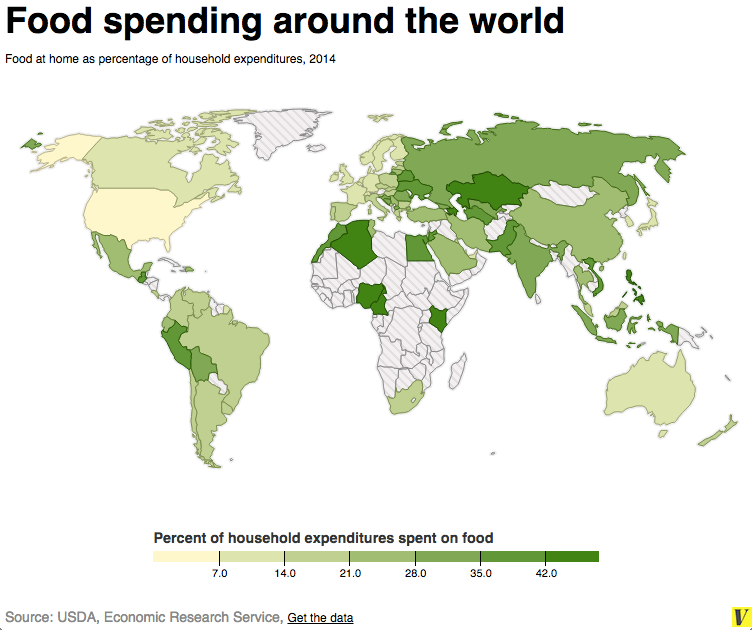

A method I find more palatable is to focus on the market size based on discretionary income in Africa against your target market. In addition to the amount for the items bought online, the typical eCommerce shopper would need discretionary income to afford internet access and shipping fees. Before I dive into the weeds on discretionary income, let me highlight a key fact that may or may not be obvious to you. In Subsaharan Africa, except South Africa and Botswana, everything competes with food for the share of the wallet, as illustrated by a 2012 research that found that 20% of respondents sacrificed food or bus fare to buy airtime.

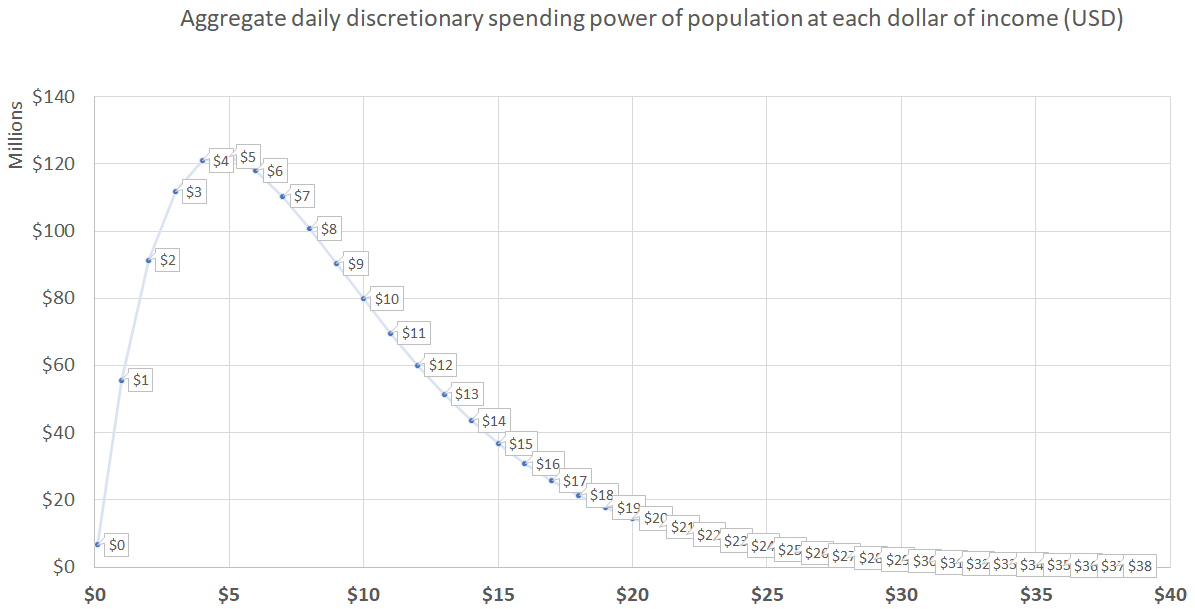

Now with that context, let's discuss discretionary income. For this, I highly recommend this article by the DFS Lab, which includes the graph and quote below.

Interestingly, the spending power (calculated as the area under the curve) of the consumers in the $5-$10 band of income (which comprise only ~10% of the population) is about double that of the $0-$4/day group (which comprise ~85%). From our experience, these $5-$10 consumers are fairly coherent as a group — i.e. more similar to each other than to $20/day upper income or $2–4/day consumers below them — and thus represent a coherent market segment with significant spending power.

In conclusion, the B2C eCommerce market in Sub-Saharan Africa exists from about $5 per day of discretionary income, resulting in about an addressable market of about 160 million people spread over a huge area. This underlines why Jumia's average order value is $36 and why they switched to focus on consumables. It is the only way to grow their customer base. If you did not read my breakdown on Jumia's numbers, check it out here.

The B2B opportunity is larger. Eventually, all offline trade will move online. However, the B2B question will be more about how to capture the value created.

Assessing the market

Now that we have addressed the market size question, the next question is to determine where the opportunities in retail eCommerce exist and answer the question I asked before, has the eCommerce market stagnated?

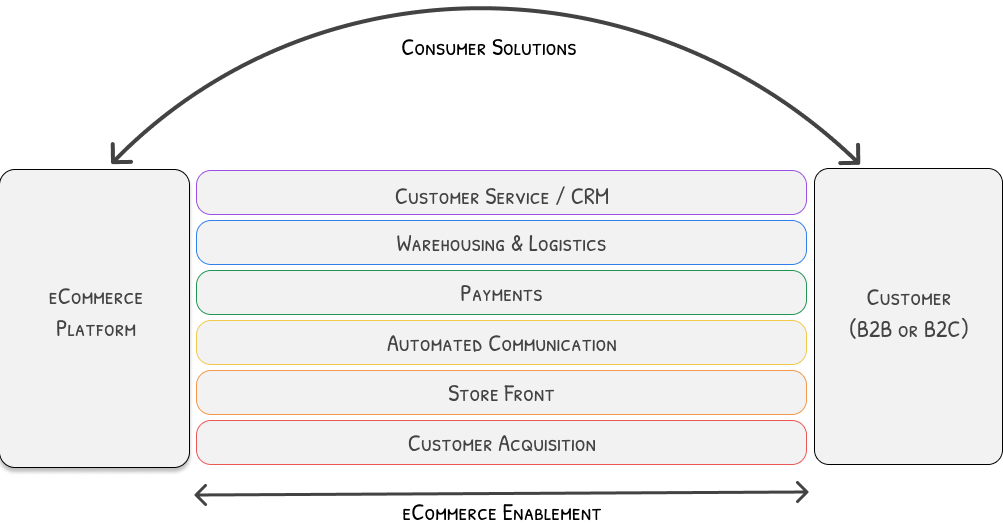

A simple way to think of the retail eCommerce market is by viewing it as:

Consumer Solutions

These are those that sell to customers via online channels, and they hide the complexity of product sourcing and delivery from the customers. It includes both B2C, B2B and marketplace products.

Ecommerce in Africa had its moment in the sun between 2009 and 2012. There was a brief resurgence between 2018 and 2019 that was then accelerated by the pandemic. The 2009 to 2012 period focused on consumer solutions. Jumia, Takealot, Konga and others were founded in this period.

B2C consumer solutions today is growing on the back of on-demand delivery channels, like Uber Eats, Glovo, Safeboda etc.

B2B consumer solutions for small retail shops one of the hottest spaces right now, with so many startups launching. Read my latest round-up article to see what I mean.

eCommerce Enablement Solutions

These are businesses that serve those in consumer solutions by building solutions for their back-office operations.

The current eCommerce enablement map is clustered around three areas:

- Payments - Solutions to collect money online. Several payment gateways are active across the continent, from Paga to Paystack and Cellulant to Pesapal. These payment gateways are also facing competition from mobile money services that are also targeting developers.

- Storefronts - These are software solutions that allow merchants to set up their own eCommerce stores and sell directly to customers. A storefront only offers technology, and the merchant has to figure out all the other parts of the equation. Almost every payment gateway has a storefront solution. The usage and success of storefront solutions have not been demonstrated yet. Thus they are losing out to social media pages.

- Logistics - Delivery via third-party logistics companies is a core feature of most eCommerce. Thus it's a natural fit here. On-demand delivery also increases the need and demand for tighter integration of logistic partners with eCommerce sellers. However, it remains a loosely coupled relationship rather than a tight one.

Where opportunities exist

I would argue that most of the opportunities in retail eCommerce exist around the enablement area. As illustrated earlier, the average user has low discretionary income; as such, eCommerce sellers need to run lean operations to improve their chances of being profitable.

Based on my experience, I see opportunities in the following areas.

- Customer Acquisition - Ideas and tools to help small sellers be discovered.

We are not out of the woods and I know there are many with small businesses that are going through a lot to make ends meet.

— Oliver Mathenge (@OliverMathenge) June 29, 2020

For the next 24 hours, I will pin this tweet on my profile.

Reply to it with your hustle as a new client/customer may be here.

My job will be to retweet pic.twitter.com/ZhIiw5fNxN

- Automated communications - Most eCommerce retailers field the same queries multiple times via social media channels. They need tools to help them design automated but "human" interactions. At the same time, allowing them to focus on their core functions.

- Multi-vendor management tools - Those running marketplaces need solutions that will enable them to manage multiple vendors at scale.

- Warehousing Tech - Most warehouses have little to no tech to organise and automate work. There is also a need for more warehousing-as-a-service solutions like Parcel Ninja.

- Reviews - Someone needs to build the TrustPilot of online shops in Africa.

Aaaanyway.

— Magunga 🇵🇸 (@theMagunga) August 10, 2020

Buy from @NovConquer (shoes) @Kurlycheeks (hoodies) @6footBarefoot (furniture) @CraftsRift (furniture) @MsMukabi (alcohol)

They will never call your money ‘small small’ and they won’t call you bitches.

- Escrow - Cash on delivery in Africa is a solution to a trust problem. Can having an independent escrow service solve that?

Thanks to COVID-19 and my inherent laziness I have been shopping on IG quite a bit.

— Elsa Majimbo stan account (@RookieKE) August 21, 2020

The challenge with IG is you don't know what you're buying until it gets to your door.

No physical shop so where do you return the stuff if you're unhappy?

There are many other ideas that one can think about by focusing on enablement. The diagram above is not exhaustive of the opportunities that exist around retail eCommerce enablement.

The market is definitely not stagnant, and it is just getting deeper, thus less noisy. As the saying goes, still waters run deep.

As usual, thanks for reading. Have any thoughts or follow-ups to the above article, email me on start {at} learnbytrying.com.