Hopes for 2023 - Part 1: New Paradigms For Discussing Africa’s Tech Consumer Markets

From the emergence of internet service providers in the 90s, web development agencies in the 2000’s and software startups in the late 2000’s up until today; the African technology landscape has grown by leaps and bounds. However, how we discuss and think of the African technology markets has largely remained framed around the geographies and borders of the countries on the continent or their location. For example, Nigeria or Kenya, Subsaharan Africa (SSA) or Middle East & North Africa (MENA) and Anglophone or Francophone. Then within these regional blocks, we only further consider income, with the bottom of the pyramid (BoP) being the buzzword of the 2000s and 2010s. However, even these income descriptors fall short of capturing the intricacies of the African market even within one country. Anyone who has tried expanding a product from Nairobi to Mombasa (both cities in Kenya) will attest to the stark differences in the cultures that require fundamentally different strategies and approaches for a successful GTM.

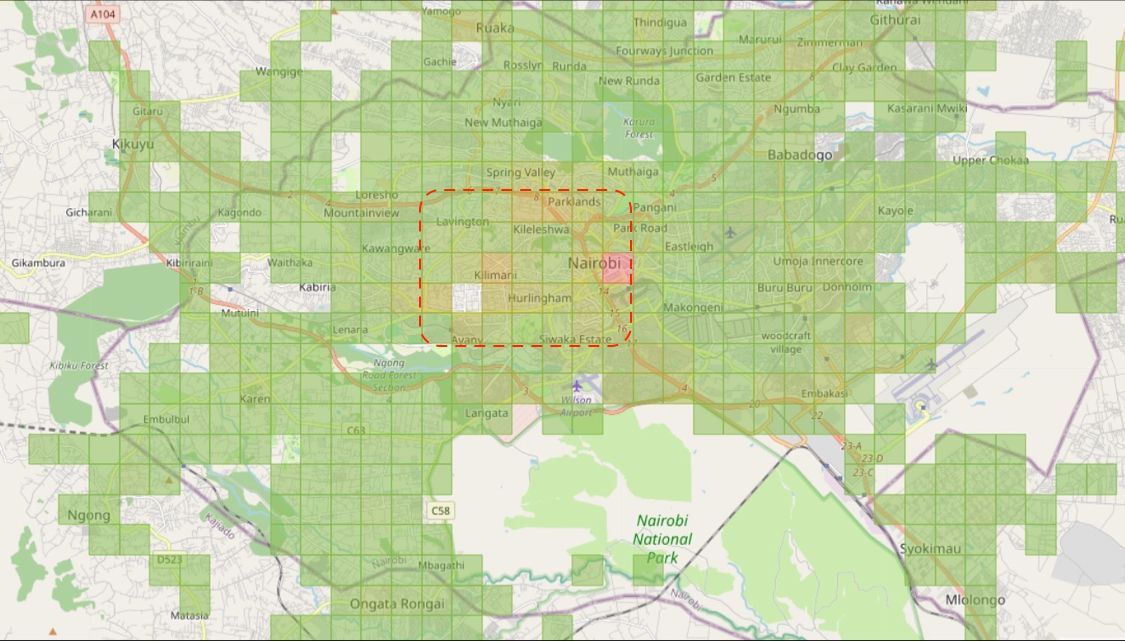

It is a well-known fact for those running eCommerce and online ordering applications that a particular nucleus of Nairobi is responsible for between 60% to 80% of all the orders in the city. In essence, this nucleus represents a concentration of people with disposable income who are also very tech-savvy. Having customers in this nucleus is a blessing and a curse for most startups. The blessing is that these customers will likely be easy to acquire and retain if the service is good. However, they are a curse in that most startups assume that these customers reflect the rest of the consumers in the city and country, thus encouraging them to accelerate marketing under the impression that they will cross the chasm and have mass adoption without further improvements in their products.

The African technology space is mainly in the imitation phase, where we build the X for our local African markets. Where X is usually a successful American startup, for example, Jumia’s listing on the NYSE billed them as the Amazon of Africa. Similarly, other startups have taken a similar approach - Takealot (Amazon), Iroko (Netflix), Pesapal (PayPal), Africastalking (Twilio), Stitch & Paystack (Stripe) and countless others. This is a natural part of the evolution or learning journey.

This imitation phase has likely been prolonged by investors looking at Africa with a lens applied from another market, most likely India or South East Asia. Anyone who has tried pitching an investor in Africa will be familiar with their desire to find a simple framework to understand your business, usually by layering a more established business model from another market on your business. Investors are also pushing startups active in West Africa to launch in East Africa and vice versa, mainly due to a high-level assessment of the markets due to GDP and population numbers. The inherent assumption is that the customers are similar dues to their income levels. Nothing could be further from the truth.

This premature expansion results in wasted capital as startups attempt to enter new markets while they haven’t figured out how to scale beyond the early adopters in their home markets. The Nigeria - Kenya expansion axis promoted recently by venture capitalist needs to be rethought, as most of these expansions result in losses with minimal upside.

Lessons from India

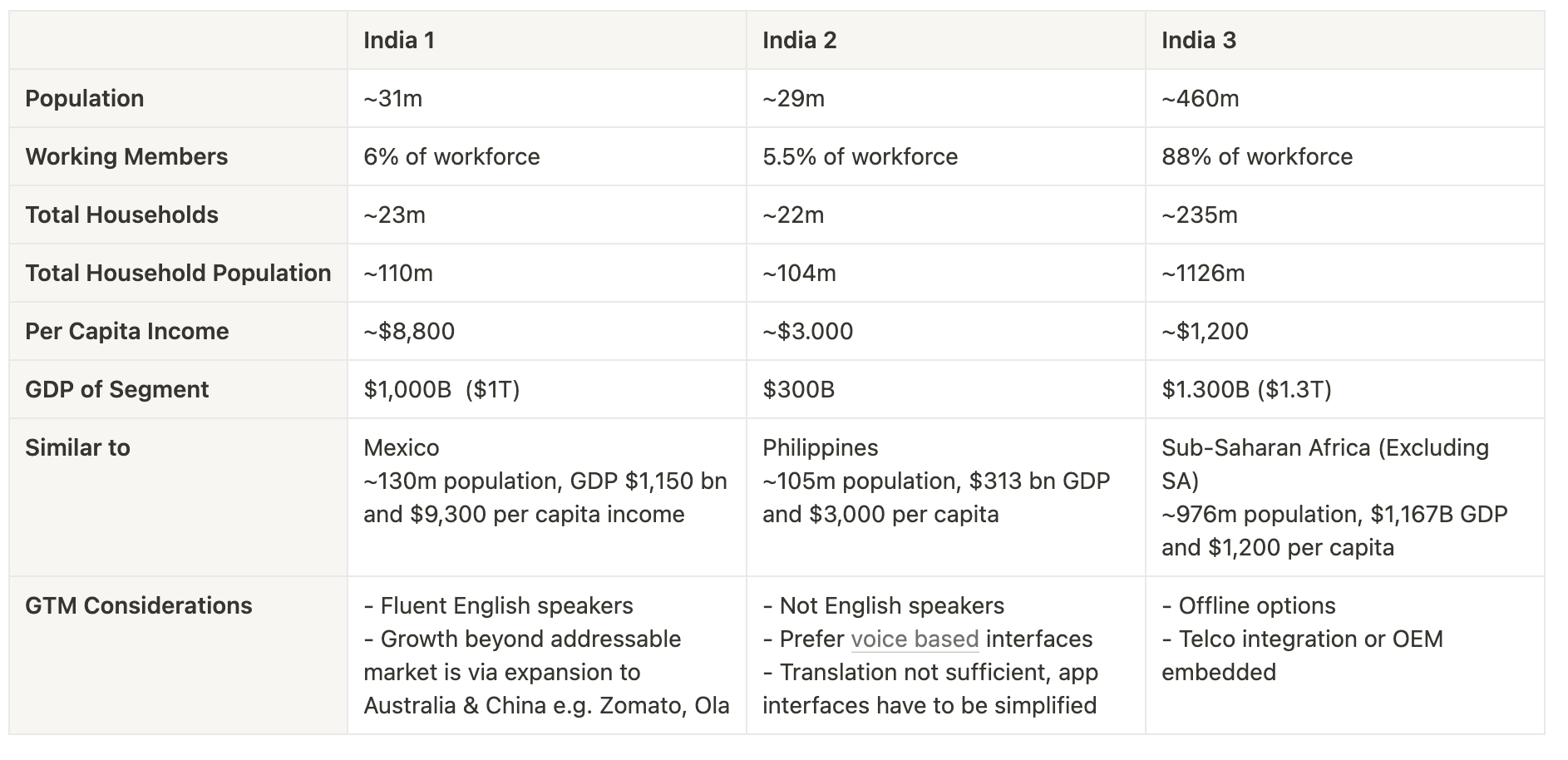

For the tech industry to progress, we must develop a new framework to discuss and understand local African markets. India’s tech and startup industry has accelerated because they have been able to understand and communicate to outsiders (read investors), a great framework to understand the Indian market. Commonly referred to as the Indian stack, popularised in 2018, it segments India’s population based on their income, thus breaking down a market of over 1 billion people into distinct markets.

What I love about this framework is it sheds light on the realities on the ground that would need to be overcome by a startup hoping to scale from India 1 to India 2. However, it also shows that blindly copying successful India 1 startups in Africa will likely fail the market size, and potential revenues to be earned are likely to be smaller.

It also highlights some challenges in Africa that need to be overcome to gain mass adoption, namely - language localisation, rethinking of interaction interfaces like voice or text and how to structure partnerships for win-win outcomes.

Bonus: India's use of voice search is two times more than anywhere else in the world - Link.

Conclusion

In reality, while a shift away from English might be the key to unlocking user adoption in Africa, the translation challenge might not be something most startups can undertake, considering the lack of uniform language across the continent with Hausa, Arabic and Swahili being the most popular native languages. However, it presents a potentially new market for B2B SAAS companies (an area I will discuss in part 2).

The value of a new paradigm to frame the market will help communicate where the opportunities for value creation exist and help define paths for capturing that value.