eCommerce Business Models - How Marketplaces, Like Jumia, Make Money

Learn how marketplaces make money. See how much Jumia made per order in 2020.

In 2017, Safaricom launched Masoko, an eCommerce marketplace. It was deprioritized in 2020 after failing to meet expectations.

I worked on Masoko until 2019, thus had an insiders view of its struggles. There are several explanations on why it struggled in the consumer market.

But, the main reason it failed to meet the company's expectations was a misunderstanding of how marketplaces make money, which had resulted in optimistic projections and undisciplined cost management.

This is the first of a series of posts on the different types of profit models in the eCommerce space. The focus here is to understand what activities bring in money and which ones result in costs. The nuances or uniqueness of business models is beyond the scope of these posts.

I aim to give a simple framework that anyone can use to understand an eCommerce business.

PS: I will not go into the economics of customer acquisition and retention or how to build a marketplace.

Table of Contents

What is a Marketplace?

Marketplaces are one of the most common business models for online businesses.

When a website facilitates a transaction between two parties, it becomes a marketplace. Jumia, Amazon and Etsy connect buyers and sellers. Uber and Bolt connect riders and drivers. Airbnb connects travellers and homeowners.

Marketplaces work best when the market is very fragmented. That is, there are many buyers and sellers. They also work best when the consumer is indifferent to the supplier. The customer is willing to buy from any supplier who can meet their quality and price demands.

Because marketplaces sell other people's products, they need less money to start.

So are OLX, Jiji or eBay marketplaces? No. These are classifieds.

The Difference Between A Marketplace and an Online Classified

Though marketplaces and classifieds have similarities, the main difference how they handle transactions.

Classifieds, usually do not process transactions between buyers and sellers. The transactions happen offline or via third party payment methods, like escrow. This reduces the liability of classified platforms from the acts of malicious users.

Unlike classifieds, marketplaces process payments of the transactions on their websites. In most cases, the customer pays for the goods or service via the marketplaces rather than to the seller. They take part in the transaction, thus increasing their liability. If you don't get what you paid for, they can refund you.

Marketplaces make money by taking a commission from the transactions they process.

It is important to note that commission revenue is often not enough to sustain a marketplace. Successful marketplaces have more sources of revenue to supplement their commission revenue. This is why some marketplaces charge delivery and or payment processing fees. Supplemental revenue is key.

The Profit Model of A Product Marketplace

A product marketplace sells physical goods that need delivery.

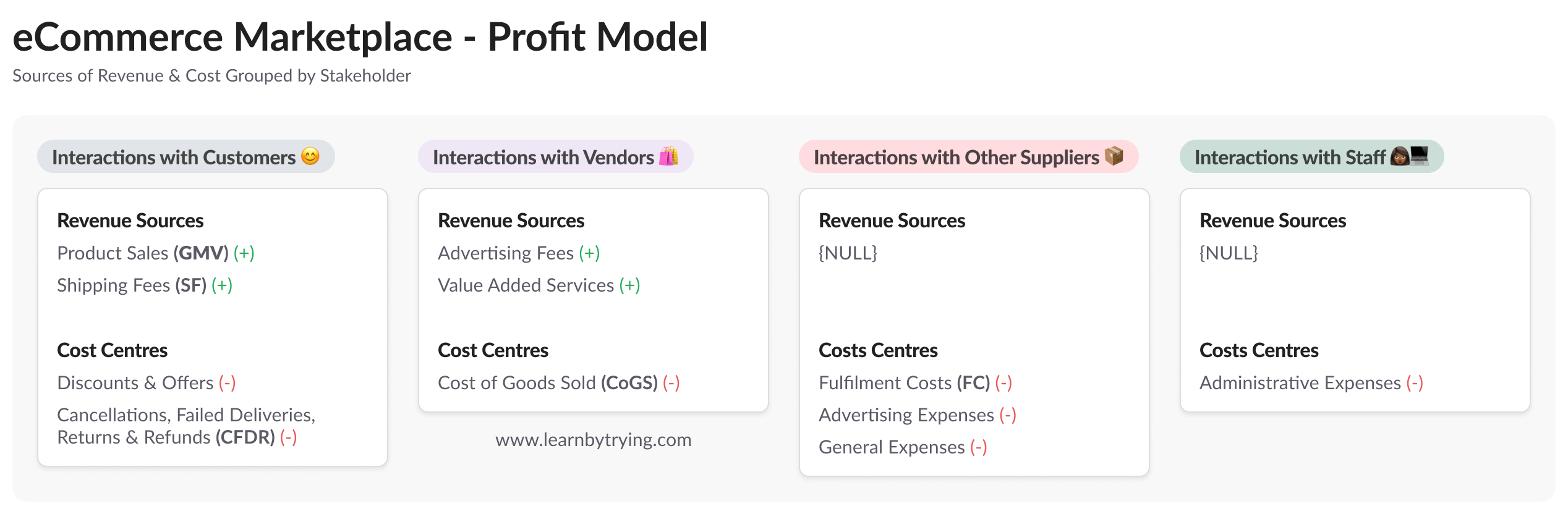

As it interacts with its buyers, vendors, suppliers and employees, a product marketplace makes and spends money.

A product marketplace that only makes money from its customers is likely unoptimised. Such a marketplace is also likely to be losing money with every order delivered.

The ideal state is to make money from both sellers and buyers. But, making money from both sellers and buyers does not guarantee profitability. However, it increases your chances of being profitable at a gross margin level.

The diagram below shows some of the revenues and costs that a product marketplace could have.

Let's see how these combine into a financial statement.

Step 1 → Always start with Gross Merchandise Value (GMV)

This is the value of all goods sold on the website in a given period. Price of items sold multiplied by the quantities sold.

Step 2 → Deduct Cancellations, Failed Deliveries and Returns (CFDR)

It is a commonplace to have a returns policy when selling online. These return windows have an impact on when you can recognise revenue from a sale.

Due to addressing challenges, some deliveries might fail to happen. Also, some customers chose cash on delivery, then fail to pay for the goods, resulting in a cancelled order.

Deduct these cancelled or returned orders from GMV.

Step 3 → Deduct Marketplace Commissions to get the Cost of Goods Sales (CoGS)

As marketplaces sell goods on behalf of third parties, calculate the marketplace commission.

Deduct the marketplace commission from the balance at step 2 to get the cost of good sold.

Step 4 → Add Shipping Fees (SF)

These are the fees paid by customers to have their goods delivered. As mentioned earlier, this is a supplementary revenue source; hence it's added to the marketplace commission.

Step 5 → Add Any Additional Revenue

Extra revenue could be generated from fees charged to vendors. These are from services such as advertising, photography or warehousing fees and other professional services.

Step 6 → Deduct Fulfilment Expenses (FC)

These are variable costs incurred in packaging and shipping orders.

Gross Profit after Fulfilment (GPF) is what you get after this deduction.

Step 7 → Deduct Other Expenses (SG&A)

Combine advertising, discounting costs and general expenses. Then deduct them from the Gross Profit after Fulfilment (GPF) to get net profit or loss.

Jumia's Profit Model

Let's take a closer look at the profit model of Jumia by reviewing its 2020 financial statements.

First, it is important to note Jumia is NOT a pure marketplace. They don't only sell other vendors products. They sell some products as first-party sellers; that is, they buy some goods wholesale. Break the bulk and resell them at retail prices. Despite this, its financial statements are structured as closely to a marketplace as possible.

Jumia has diversified its profit model by introducing several revenue lines. These include revenue from first-party sales, advertising, value-added services and shipping fees.

Jumia in 2020 had:

Gross Merchandise Volume (GMV): €836.5M

- This is from 27.9 million orders.

- Thus the average order value is €30 ($36).

Cancellations, Failed Deliveries and Returns (CFDR): €209.12M

- This means 25% of orders are unsuccessful.

- They also mention that CDFR is higher for more expensive items. But if the average order is $36, then what does expensive mean?

Cost of Goods Sold (CoGS): €592.78M

- They did not provide this. Thus I worked backwards to calculate it. It might not be accurate, but I believe it is close to accurate.

Marketplace Commissions: €34.6M

- This would put the average marketplace commission at about 5.8%.

- 40% of GMV comes from phones and electronics, which have at most 5% commission. An overall marketplace commission of 5.8% thus looks realistic and could confirm the CoGS above.

- This means from an average order of €30 ($36), their revenue is €1.74 ($2.08)

Shipping Fees Revenue: €32.4M

- Jumia charges both vendors and consumers for shipping thus has higher revenue from this arm.

- They also have a large share of international orders, which have higher shipping fees than domestic routes.

- This represents €1.16 ($1.39) in shipping revenue per order.

Additional Revenue - Marketing & Advertising: €7.7M

- Brands and vendors buy prominent branding slots in their promotional events, like Black Friday. In 2020, they had campaigns for over 150 different advertisers.

Additional Revenue - Value Added Services: €19.1M

- Vendors and brands also pay for content creation, logistics services and packaging material.

Fulfilment Expense: €69.3M

- They had 27.9 million orders. Thus the average order costs €2.48 to deliver. This includes cancelled and refunded orders.

- There might be multiple delivery attempts for failed deliveries and returns.

Gross Profit (or Loss) after Fulfilment

- Let's add up the numbers now. We start from the market commissions, as it's already taken care of GMV and CoGS.

- €34.6M + €32.4M + €7.7M + €19.1M - €69.3M = €24.6M

- Even after all the income diversification, Jumia is making a gross profit of €0.88 ($1.05) per order.

Wrapping Up Jumia's Data

In total, Jumia made a loss of €5.35 ($6.42) per order sold in 2020. That significant improvement from the loss of €8.6 ($10.3) per order in 2019.

Jumia's advertising, payments and logistics businesses have resulted in their first gross profit after fulfilment since its launch 8 years ago. Should these additional revenue lines continue to increase, the business is bound to be profitable in a few years.

The Profit Model of a Service Marketplace

Service marketplaces are similar to product marketplaces except that their suppliers provide a service and not a physical product.

Uber and Airbnb are the most recognizable service marketplaces. Others in Africa are Glovo, Kobo360, Sendy, Eden, SweepSouth, Yep and many others.

The profit model of a service marketplace only differs from that of the product marketplace, which is they have more revenue levers to work with and might have no fulfilment expenses.

Service marketplaces can explore the following revenue models:

- Booking Commissions - They take a percentage of the booking fee for the service.

- Subscriptions -They could offer a fixed recurring fee for services they offer.

- Enterprise Premium Payments - Those who sell to enterprise customers can charge a premium for services like dedicated account management and guaranteed response times.

- Product Sales Commissions - Some services marketplaces sell products to their customers. But, they limit the variety of products.

- Value-Added Services - Service marketplaces can add fees to the products that they sell. For example, Airbnb charges a service charge and cleaning fees.

Overall, service marketplaces have a better path to gross profitability, but the real challenge with service marketplaces is product-market fit.

Lessons To Be Learned From Marketplaces

When building a marketplace, businesses diversify your sources of income as much as possible.

Gross Merchandise Value is a vanity metric. It hides a lot of detail. Focus on the other metrics mentioned above.

Product marketplaces can struggle due to the costs of deliveries. In the example above, we have seen Jumia is earning a combined €2.9 in commissions (€1.74) & shipping fees (€1.16) per order but spending €2.48 to deliver the orders. Therefore, rethink any promises for free delivery or at the very least understand what it means for your business.

Make sure you have adequate financing to sustain your business at the start. It is doubtful that vendors will be willing to pay for services on an untested website.

Customer promises around free and fast delivery, cash on delivery and return windows might pay off in the future but need to be financed today.

Align your board and or investors on the length of the payback period. It will take many years.

Keep an eye at your revenue or loss per order, commonly referred to as unit economics. If your business losses money with each sale, success could kill the business.

Overall, I believe marketplaces are great businesses. They need to be understood better.