Did COVID-19 Accelerate eCommerce Adoption in Kenya?

The initial lockdowns as a result of the pandemic brought about increased interest in eCommerce in Kenya. A year on, has the interest been sustained?

A year after the pandemic and my analysis on the pandemic's immediate effect on eCommerce, it's time to check if the initial boost has been retained and sustained.

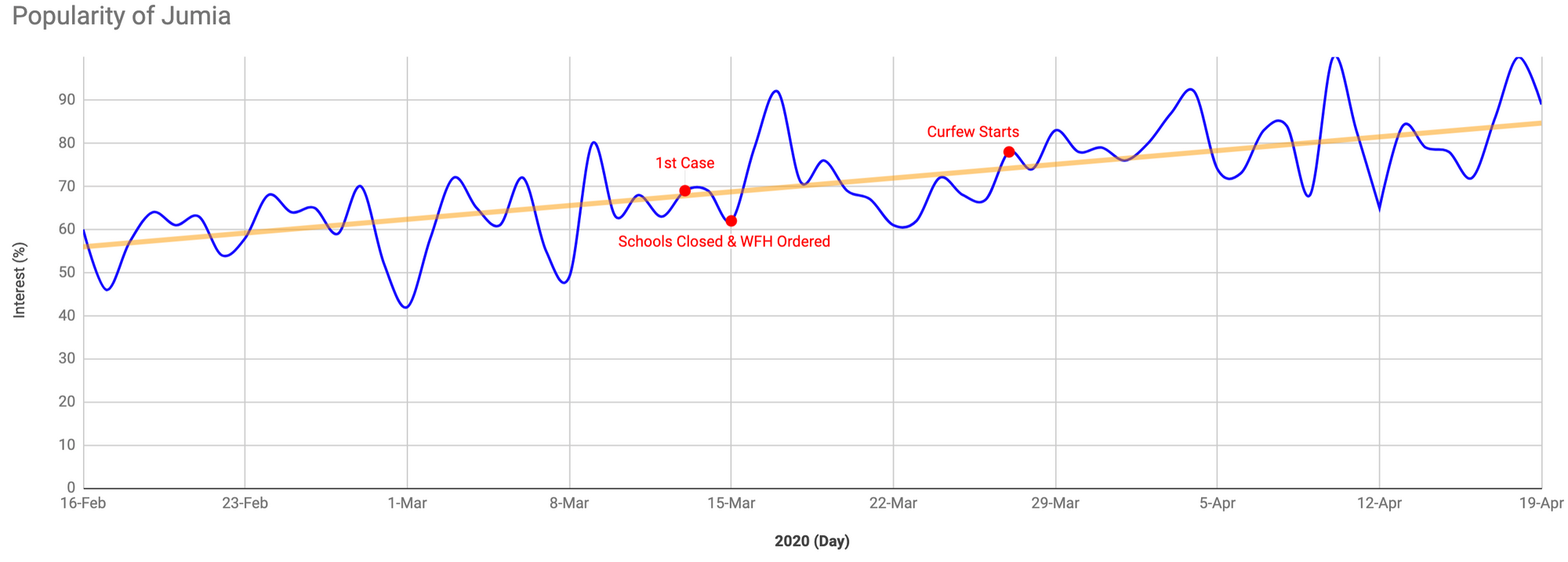

Last year, I benchmarked my observations on Google Trends and Google's mobility data for Kenya's major cities. To recap, the weeks immediately after Kenya's first confirmed COVID-19 case, foot traffic to retail establishments and supermarkets dropped by up to 52%. While at the sale time, the search interest for Jumia trended upward, hitting highs of about 90% of the previous highest volume by mid to end April 2020. The original post is available here.

Below: The original graph published in April 2020, of search interest for Jumia between February and April 2020.

How have things played out?

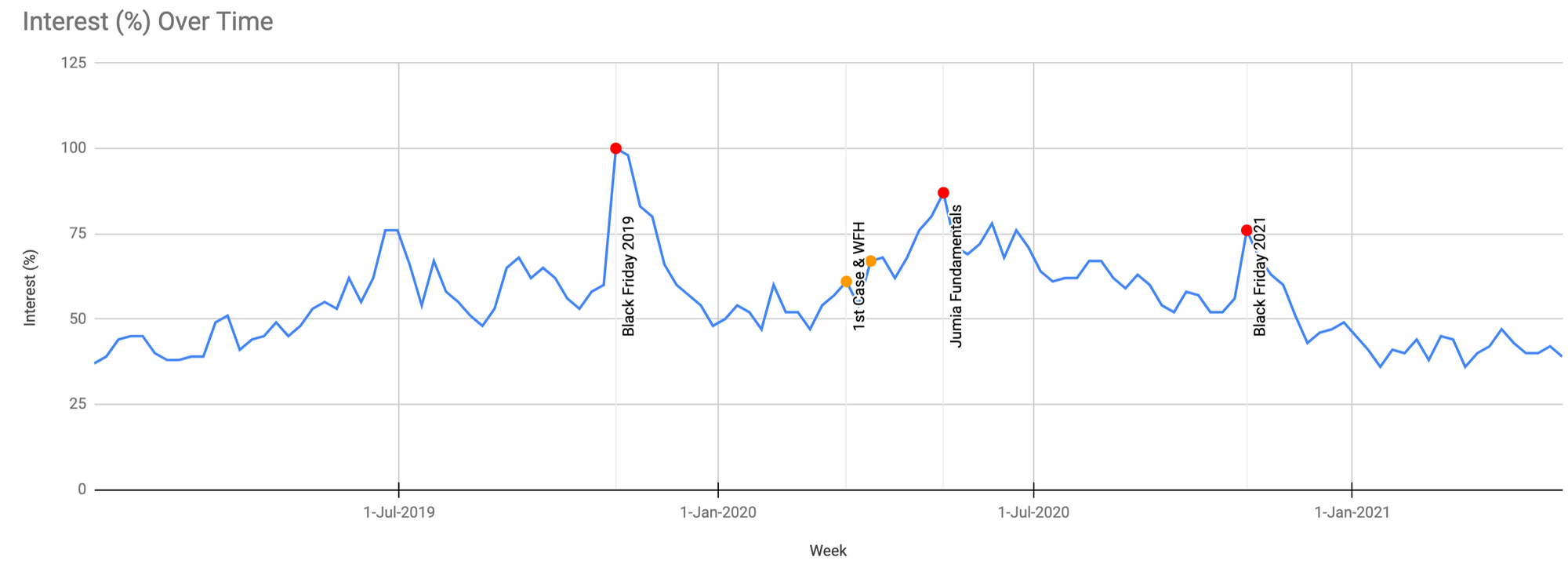

For consistency, I picked out the same data sources but zoomed out and incorporated the whole of 2019 and 2020 data and the 1st four months of 2021.

Google's mobility data shows foot traffic to retail outlets at the end of April 2021 is now 2% above the baseline number, while foot traffic to supermarkets is now 24% above the baseline. In addition, a review of the search popularity of Jumia reveals a steady decline (see graph in the Jumia section below).

Therefore, both data sources suggest that the initial interest in online shopping did not stick; over time, people went back to their regular habits. Without actual purchase data, this in itself is not conclusive but gives us something to think about. Did you try shopping online last year? Are you still shopping online? Let me know in the comments below.

So does that mean that the COVID-19 did not accelerate e-commerce adoption in Kenya?

Well, not necessarily; there are several reasons why search volume can drop, including an increase in direct traffic to Jumia. Alternatively, it could point to a decline in the popularity of Jumia and not a decline in the entire industry.

A closer look at the Jumia data

Jumia's search interest peaked between 10th and 16th May, beating the interest in their Black Friday offers.

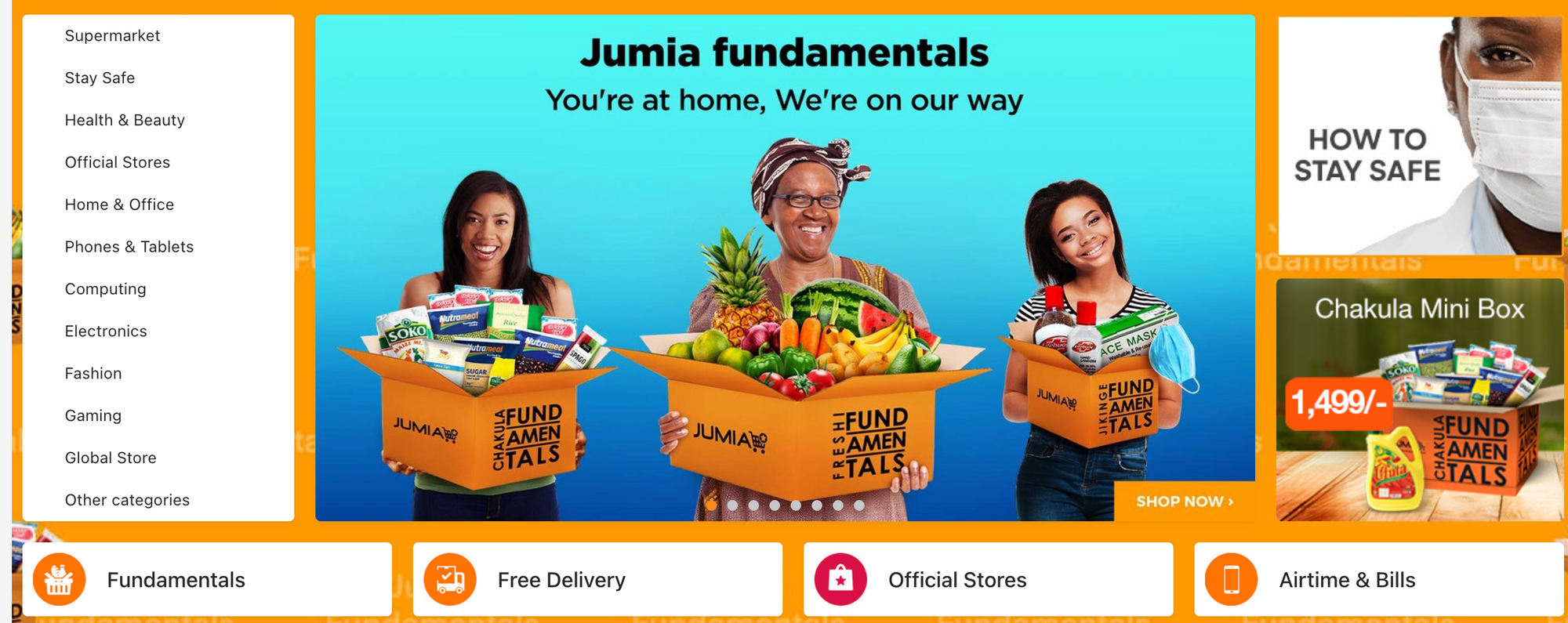

So what was happening in May? A quick review of their marketing calendar shows they ran a Jumia Fundamentals campaign, which had offers on food and grocery items. Considering that this was still at the beginning of the pandemic and early days of the government lockdowns, it is a no-brainer why interest was high.

Other things that jump out are:

- Interest in Black Friday in 2020 was 30% lower than the interest in 2019, perhaps a factor of less income or perhaps a tapered marketing campaign by Jumia.

- The average search interest in 2021 is lower than it ever was at any time in 2020.

- Jumia has pivoted away from Phones and Electronics as its main focus categories to focus on FMCG and groceries. The business implications of this shift would be smaller average order values (AOV) but larger volumes. There are many other implications of this change that I will cover in future posts.

2019 Black Friday - Focus on Global, Phones, Electronics & Computing

2020 Black Friday - Focus on Supermarket, Health & Beauty, Home & Office then Electronics

Jumia's shift to food and grocery as their primary call to action and focal point is an interesting signal of either attempts to increase the frequency of repurchase or a defensive move to repel potential competition, who might be eating into their search volume.

Benchmarking

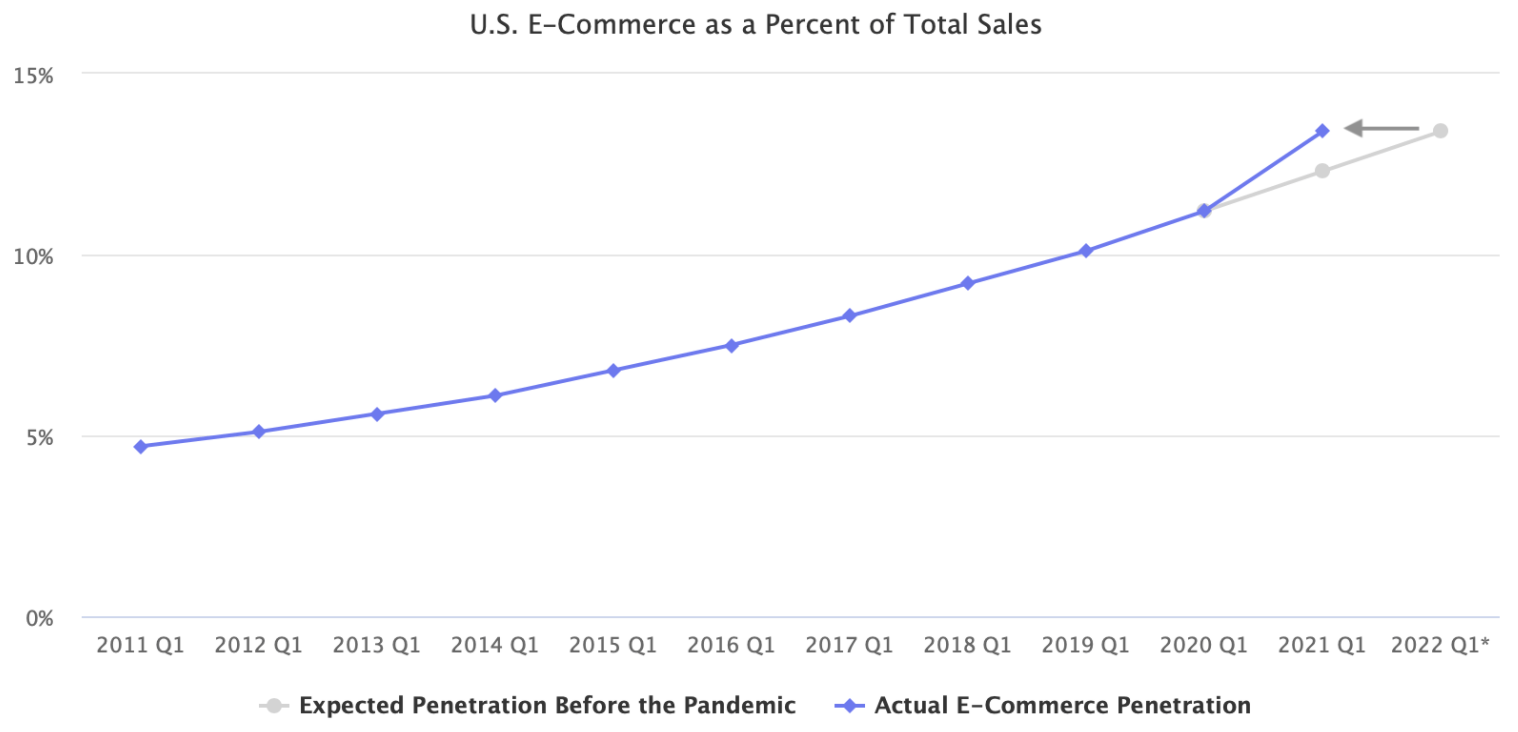

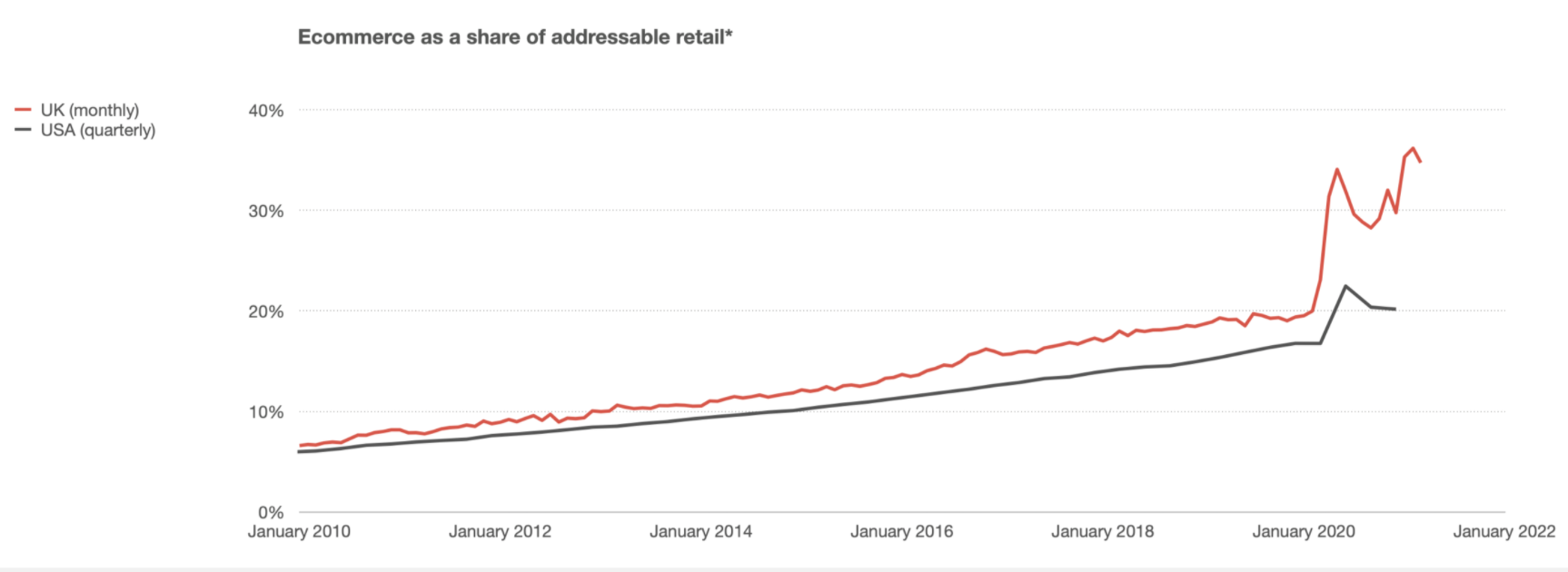

Globally, eCommerce adoption was actually not as accelerated as previously thought. The adoption is one year ahead of where it was predicted in the US, whereas, previously, it was estimated to be about 3 years ahead.

The UK seems to have done the most to retain the gains, but it also had stricter lockdown restrictions. As things go back to normal there, I will continue to observe how it will play out.

Either way, we are still quite early in the journey, and we shall continue to map the progress here.