Classifieds in Africa

What happened to OLX? Were they making money? Let's learn about classifieds and the key players in the African market.

OLX was one of the largest advertisers in Kenya between 2013 and 2016, outspending most. Then suddenly, in February of 2018, it announced it was winding down operations in the country.

What happened? Why would a company spend almost 20 million dollars on customer education and brand awareness and then leave the market? More importantly, how was it making money to justify that investment? Did you ever get charged to use OLX?

This is the second of a series of posts on the different profit models in the eCommerce space. This post is on Classifieds. I had previously covered marketplaces here.

I aim to give a simple framework that anyone can use to understand the online classified business model, especially regarding what activities bring in money and which ones result in expenses.

The factors of success for an online classified is beyond the scope of this post. However, I will use existing market players to highlight the strategic advantages of classifieds. As well as their relationship with the newspaper or media industry.

Table of Contents

Classified Definition & History

Classifieds are advertisements placed on noticeboards and periodicals, such as newspapers and magazines, that sellers and buyers use to express willingness to sell or buy something. They are commonly organized in categories, hence the name.

In newspapers and magazines, classified ads provided an affordable and effective medium for parties to connect. Classifieds are not limited to goods for sale. Advertisements of jobs, houses for rent, auctions, tenders and even personals (looking for love) advertisements are considered classifieds. Though less flashy than the more mainstream full, half or quarter page advertisements, classified revenue provided a great base from which media houses built their empires. More so for the local or small publication with a small footprint and distribution.

The typical classified charged per word and extra for elements such as colour and or images. Customers also had to pay for each day the classified was published.

As the Internet took off and more people started using it, it was only natural for classifieds to shift online. However, due to low overheads and hyper-competition, most online classifieds built their business models free to post and search. This counter-positioning stance made it impossible for the incumbent media houses that owned the newspapers and magazines to compete with them, as they would instantly cannibalize their lucrative classified revenues. Therefore, they mostly ignored them and went about their businesses as usual. But, on the other hand, customers saw the benefits of using these free online classifieds, as they reached more people for less money and were able to add more details to their listings.

Craigslist is one of the earliest and most successful classifieds. It is still free to post items for sale in most of its categories.

Segmentation of Classifieds

Classifieds are usually categorized as consumer-to-consumer (C2C) businesses, despite having some businesses sell on them.

The broad segmentation of classifieds is based on what they advertise to sell. You can have either:

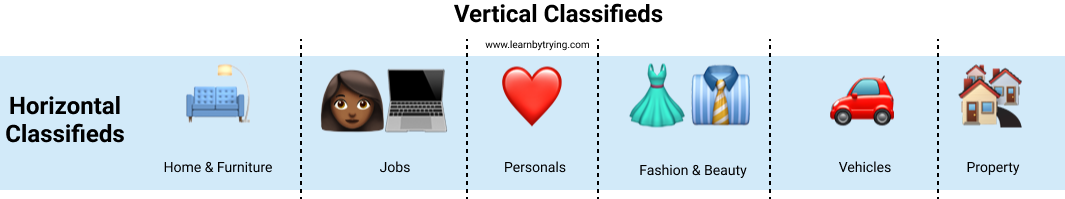

- Horizontal Classifieds - These have a mix of items from different categories. On a horizontal classified, you can find farm produce, cars, toys, clothes and lots of other items.

- Vertical Classifieds - These only have items from one category. For example, cars only, jobs only, clothes only etc.

An Emerging Segment - iBuying Classifieds

Traditionally, classifieds did not participate in transactions and only provided the communication mechanism between users. However, in the last two years, some well-funded classifieds have pursued an aggressive strategy to purchase items directly from sellers; usually, cars or houses from customers. Then resell them. Examples of these are OLX Autos in Asia and LatAm and Opendoor and Zillow in the U.S.

This new category is referred to as iBuying (instant buying). The websites rely on the data they have to determine similar car or home prices, thus offering sellers an instant purchase price. The instant price is usually lower than the market price. However, sellers might opt for it to save on time or the administrative hustle of negotiating with several potential buyers later.

iBuyer classifieds also provide buyers with additional resources, such as credit, transaction facilitation and transfer management services.

The Classified Profit Model

As mentioned above, most classifieds offer the basic functionality of posting and searching for free. Which begs the question, how do they make money?

To understand the classified profit model, it is important to review its history and understand its strategic advantages.

Classified listings are unique points of data that are generated in any given location. Classifieds have powerful network effects and tend to be winner take all or most markets, with all the commercial benefits accruing to the market leader. Once a classified platform becomes the default method to find or sell something, customers will have no options but to pay.

To capture the market, the first few years of a classified platform's founding are usually used to build awareness and listings (number of items posted). These early years require teams of people and or web scrapers to search the Internet for listings and post them on their target classified website. The use of web scrapers is common and hence why classifieds have watermarks on their images. The watermarks help them find violating websites and or prevent copycats from having listings with photos. Listings with photos have more interest and are more likely to generate user interest.

Without the web scrappers, new classifieds have to hire large teams of data entry agents to find and enter data on their websites. These new listings could come from notice boards, Facebook groups, WhatsApp groups and other non-traditional sources. The larger the data entry team, the higher the wage bill in the early years. In addition to these costs, they will also incur marketing and advertising costs in these early years.

Early Years: Little to no revenue. High listing acquisition and marketing costs.

The earliest monetization options are, therefore:

Advertising

Monetisation via ads can happen very early on classifieds, especially when using Google Adsense. Later, classifieds can sell banner adverts to customers.

Sponsored listings

As a classified category gets, competitive sellers might be willing to pay to have their listings highlighted on the website. A sponsored listing can be offered as an upsell on a free classified.

Later Years: Several monetization options + Lower or Stabilised Overheads

Over time, if successful, some classifieds can generate more organic listings than internal data entry teams can find and post. At this point, they can try to monetise. In addition to advertising and sponsored listings, there are various ways to monetise a classified. These include:

Listing fees

Once a classified is known in a specific market, they can charge users for posting their listings. For example, Cheki charges a fee to post a vehicle for sale, and LinkedIn charges a fee for jobs posted.

NB: Listing fees are more likely in key verticals such as jobs, cars, real estate and personals.

Verification fees and Pro-accounts

Users tend to be very cautious of listings posted on classifieds. This lack of trust creates a market for sellers willing to pay to have their accounts verified to enhance their reputation and thus help them generate more interest in their listings. In addition, these verified accounts tend to be for professional sellers, thus are willing to pay for more services.

Lead Generation Fees

Some classifieds charge a fee per interaction with a listing. For example, if someone lists a carpet cleaning business on a classified, they can get charged every time someone sends them a message or views their contacts. Lead generation fees can also be earned from getting users to sign up for a service.

Affiliate Fees

Some classifieds advertise products, such as financial services products, they make a commission when users buy these products. Affiliate fees can also be for redirecting users to other websites where the customers purchase items.

Value-Added Services

Classifieds also have the option to charge for services customers are willing to pay for, for example, a temporary email or phone number to use when selling their product or reaching out to sellers.

Data

Some classifieds make money from selling their data, especially around the pricing of products.

Note:

- Even monetized classifieds take a while to be profitable. But once a classified is in the driver seat, it just needs to optimise its operations costs and be profitable.

- From a technology standpoint, the content management systems used to run classifieds are very dynamic and portable. Thus it is widespread to have companies that focus on classifieds expand to new markets or into new verticals.

Classifieds in Africa - Key Players & Statistics

The classifieds market in Africa is interesting and has complex dynamics. The traditional media houses across the continent have ignored online classifieds. Thus the classifieds landscape in Africa is largely occupied by 3 types of players:

- Social media websites: Facebook has a growing and persistent classified business largely hidden within groups and its marketplace products. This is the default marketplace for most items and most countries but has some challenges as it was never built to serve as a classified or marketplace.

- Start-ups: Several entrepreneurs have started and sold their classified businesses to large multi-national companies.

- Large multi-national companies: Most acquisitions in the classified space have been to One Africa Media (OAM) and Ringier AG🇨🇭, which are now one organisation called Ringier One Africa Media (ROAM). However, the largest player in this space is Naspers🇿🇦, a global behemoth and owner of OLX, Property24, Cars45 and several other classifieds that dominate markets in the U.S., India, LatAm, Russia and South Africa. Another interesting player is Jumia which rolled out classifieds in multiple emerging markets as a user acquisition strategy for their marketplace service.

Let quickly take a look at these 3 companies - One Africa Media, Ringier AG and Naspers.

One Africa Media

OAM came to the fore via Carey Eaton, the founder of Cheki and former CIO at Seek.com, one of the largest jobs classified in the world by market cap. With the success of Cheki, Carey was able to secure investment into OAM from Tiger Global and Seek, which he used to fund some acquisitions, thus making OAM the largest classifieds business in Africa as of 2014.

OAM at that time owned:

- Cheki - Car classified in 10 countries

- Private Property - Property classified in South Africa & Nigeria

- Jobberman - Jobs classified in Nigeria & Ghana

- BrighterMonday - Jobs classified in East Africa

- BuyRentKenya - A property classified in Kenya (OAM owned a minority stake)

- SafariNow - A travel marketplace in South Africa

Unfortunately, Carey was killed during a robbery in Nairobi in June 2014. His death and how it happened probably altered the eCommerce and startup landscape in Africa in ways we will never find out. I have embedded a video that captures his thinking around OAM and how it would play out. The clarity of vision he had is amazing. May he continue to rest in peace.

Ringier Africa & ROAM Africa

Ringier Africa is a subsidiary of Ringier AG, a family-owned Swiss media house with a rich history in emerging markets. They made their entry into the continent in 2010 via several investments in Kenya, Ghana and Nigeria. Though they have had exposure to multiple business models, they have made several classified acquisitions. Some of these include:

- Pigiame (2011) - Horizontal classified in Kenya.

- ZoomTanzania.com (2014)- Horizontal classified in Tanzania (51% acquired in 2014)

- Expat-Dakar (2014) - Horizontal classified in Senegal

- MaMaison - Property classified in Senegal (as part of the Expat-Dakar transaction)

- Qefira - Horizontal classified in Ethiopia

After the unfortunate death of Carey of One Africa Media (OAM), the investors of OAM agreed to merge with Ringier in what seems to have been a complex transaction that created a new entity called Ringier One Africa Media (ROAM) that became the owner of most of OAM's classified properties except the South African entities Private Property and SafariNow, as well as Ringier Africa's classifieds portfolio. Private Properties would in 2017 be bought by Caxton, a South African media company, then 51% sold to Cognition Holdings.

Ringier sold its interests in Cheki Nigeria and Cheki Ghana in Q3 2020 and closed its ZoomTanzania and BrighterMonday Tanzania operations in Q4 2020.

Today ROAM owns Cheki, Pigiame, Qefira, BrighterMonday, Expat-Dakar, Jobberman, BuyRentKenya and Sokoso.

Pigiame is their largest property with about 640,000 unique monthly users. Cheki, Jobberman Nigeria and Expat-Dakar have approximately 400,000 unique monthly users; BrighterMonday in Uganda is their least popular property with less than 70000 unique monthly users.

Naspers

Started in 1915 in Stellenbosch, Cape Town, as De Nasionale Pers, Naspers has grown to be a global powerhouse ranks as the 11th largest global consumer internet company by market capitalization. Naspers influence on the world's eCommerce space deserves a breakdown of its own.

As for their classified operations, though they have invested the most on the continent, their aggressive approach usually expects rapid growth. They are not shy to spend money to acquire market share, but they do not hesitate to cut down their operations if the growth rates are low.

However, OLX Kenya and Nigeria were probably not cut due to slow growth rates but due to Naspers consolidation of their classified businesses into one entity. The OLX Group most likely decided to focus on large markets, such as India, Brazil, and Eastern Europe. The OLX Group today constitutes over 20 brands, mainly in the vehicles and property verticals.

Naspers still has online classifieds via OLX in South Africa, Cars45 in Nigeria & Ghana and Property24 in 9 African countries.

Globally, Naspers made $1.6billion in revenue from their classified businesses in FY 2021 as per their financial statements, with a trading profit of $15 million.

This shows how lucrative the classified space can be once an entity achieves market capture and scale.

Notable Mentions

Other notable players in the African classifieds market are:

- Tonaton in Ghana, a product of Saltside Technologies (Sweden & India).

- Jiji in 5 countries. Jiji bought OLX's properties in Africa (excluding South Africa). It was originally a product of Genesis Technology Partners (Ukraine) but spun off into its own company.

Opportunities in Classifieds

I firmly believe we are still in the early days of classifieds in Africa. However, entrepreneurs need to develop more local solutions. For example, fresh produce and agricultural tools were the most listed items on OLX before shutting down operations on the continent. This is a huge opportunity. If you are building this, please reach out to me.

Local media houses are also struggling with revenue and relevance as the world shifts to the digital age; this will present an opportunity for mergers and acquisitions activities to early movers in key verticals.

Francophone Africa also presents a huge opportunity, Jumia's classifieds are the market leaders, but the platform does not work well for sellers and buyers. ROAM Africa and Jumia are the only ones operating in francophone Africa and are only in Senegal and Ivory Coast, respectively.

If you are looking to build and exit an eCommerce business in Africa, perhaps take time to consider a classified seriously.

Thanks for reading and see you next time.

🏁 Enjoyed This Post?

Forward it to a friend, and let them know they can subscribe here

Ben